Peter Laliberte helps guide individuals through the potential challenges and complexities of retirement planning. As a Certified Financial Fiduciary and a securities-licensed adviser, Peter brings a wealth of experience to his role as Founder and trusted financial advisor for Liberty Advisory Group. Tonie Laliberte, Peter’s wife and business partner, serves as president of the company.

Peter’s client-centric collaborative approach to retirement planning centers on preserving and maximizing income in retirement, emphasizing strategic planning, and adapting proactively to changing financial landscapes. They assist clients in finding their unique path to a more financially secure and fulfilling retirement.

With a master’s degree in both education and finance, Peter’s journey to becoming a financial adviser was fueled by a desire to break the cycle of financial hardship that had plagued his own family. He is currently host of the popular show “Retirement. Simplified! TV” and, together, Peter and Tonie provide personalized, holistic financial solutions to people nearing or already navigating retirement.

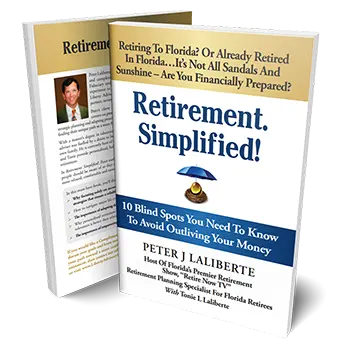

In “Retirement. Simplified!” Peter outlines in easy-to-understand terms the 10 blind spots people should be aware of so they can better avoid outliving their money and can enjoy a more relaxed, comfortable and sunny retirement in Florida.

"*" indicates required fields

Schedule a Complimentary Consultation to discuss your goals and learn more about how to pave your path toward a more confident and fulfilling retirement!

Receive a complimentary copy of Retirement Simplified upon booking a consultation! We will pay for printing, shipping, and handling as a THANK YOU for scheduling your consultation!

We look forward to hearing from you soon!